Diaspora Account

An account tailored for all individuals as well as clubs and societies of Malawians living or working outside the country.

read moreStep Up Professional

Step-Up Professional is a package designed to assist young professionals by making it easy for them to access tailor made products befitting their professional as well as lifestyle needs.

read moreSpecial Package for Accountants

Service/Product Target

Accountant Registered with ICAM:

In Stable & confirmed employment.

Those with business income and their business is registered.

Foreign Currency Denominated Account (FCDA)

Can be used to hedge against currency fluctuations

Customer can hold funds in this account and only convert when conditions are favourable.

Call Account

No bank charges

Can be used as security for borrowing.

Relatively high interest rate.

Very low risk

Once paid for each period, interest is added to the principal and earns interest in the subsequent contractual period.

Fixed Term Deposit

No bank charges

Can be used as security for borrowing.

Relatively high interest rate.

Very low risk

Once paid for each period, interest is added to the principal and earns interest in the subsequent contractual period.

Current Account

Convenient and secure cheque payments.

No service fees on personal accounts

Fiesta Save Account

No service fees.

Allows a customer to build an investment over a period of time from a monthly income

Can be used as collateral/security

Relatively high interest rate

Insurance Premium Finance

Insurance premium Finance is a specially designed facility that aims at assisting our customers with paying annual insurance premiums.

read moreAsset Based Financing Scheme

Repayment amount not to exceed 35% of salary/income

Customers qualify for high amounts.

Pricing is low with a minimum at RBM reference rate +6.1% pa

Personal Vehicle Loans

Max – Dependant on financial capacity of the customer

Maximum repayment period of 36 months for reconditioned and second hand, 48 months for brand new vehicles

Second hand vehicles should be less than 5 years.

Reconditioned vehicles should be less than 10years

Accessible by NBM and non NBM customers.

Premium Gold Finance

The Premium Gold Finance Scheme has been designed to assist customers in middle to junior managerial positions and owners of Small and medium Enterprises to fulfill their personal dreams and ambitions by providing them with top quality financial services in form of a gold VISA card, a gold cheque book, an overdraft facility, personal loans occasionally when justified and a designated cashier at all National Bank of Malawi service centres.

read moreFarm Infrastructure and Implements Loan

The Bank shall finance all eligible farmers in Malawi be it in the small- scale or Estate sub-sectors for the sole purpose of acquiring agricultural equipment and other farm implements

read morePay-Day Loan

Available in multiples of K10,000

Min – MK30,000

Max – MK1,000,000

Repayable on next pay day – within 30days.

Mortgage Finance and Home Improvement Loan

Beats inflation

Pricing is low with minimum interest rate at RBM reference rate +6.1% pa

Can be repaid before expiry at no costs

Employer Guaranteed Loans

Min – MK100,000

Max – Determined by the employer and Bank

Repayment amount not to exceed 30% of salary

Maximum repayment period of 36months

Consumer Loans

Min – MK100,000

Max – MK3,000,000, unsecured

Repayment amount not to exceed 30% of salary

Maximum repayment period of 36months

SME Facilities

To assist qualifying Small and Medium Enterprises (SME’s) with working capital, capex finance, short term loans, letters of credit, guarantees and bonds

read moreCurrency Option

A currency option is the right (but not an obligation) to purchase or sell an agreed amount of a particular foreign currency at an agreed rate of exchange, at the expiry of, or during a specified period of time.

read moreForeign Exchange Contract

A Foreign Exchange Contract is a contract between two parties whereby they commit themselves to exchange a specified amount of one currency for another at an agreed rate of exchange, settlement of which takes place on a fixed date in the future.

read moreKasupe Finance Product Offering

Kasupe Finance is a package designed to assist Village Banks in accessing financial products and services from the Bank. Village Banks eligible for this offering shall be those that have operated for at least one year and keep records of their financial transactions.

read moreFarm Infrastructure and Implements Loan

The Bank shall finance all eligible farmers in Malawi be it in the small- scale or Estate sub-sectors for the sole purpose of acquiring agricultural equipment and other farm implements

read moreFinancial Lease

A Financial Lease, one of the facilities offered by the Retail Banking Division Division is a way of financing the purchase of the capital asset(s).

read moreAmayi Angathe Business Savings Account

The Amayi Angathe Product and Service Offering has three main categories. These are; a Savings Account, Credit Facility and an Information Web Portal with dedicated Account Relationship Managers.

read moreNBM Online Payment Gateway

NBM Online Payment Gateway is an e-commerce product that allows merchants/ businesses

to accept card-not-present payments over the internet.

Visa Credit Card

This is a card issued by National Bank of Malawi to customers as a method of payment for goods and services across the globe. It has an embedded pre-approved credit.

read moreVisa Debit Card

This is a card issued by National Bank of Malawi that allows the holder to withdraw cash and it can also act as payment card that can be used instead of cash when making purchases.

read moreMo626 Digital+

A self-service, do it yourself banking solution that enable customers to perform banking transactions from their mobile phone (Android and iPhone devices) anywhere in the world anytime 24/7.

read moreContactless Card

A Contactless Card allows customers to make POS purchases and ATM withdrawals by simply holding the card in front of the payment device instead of swiping or inserting.

read moreBanknet360

A self-service channel for all basic account transactions

Relatively cheaper and efficient

Safe and secure through the use of User IDs, Passwords and OTPs delivered to the subscriber’s mobile phone and/or email inbox

Cardless Withdrawal

Cardless withdrawal is a service that enables users to cash out from their accounts through use of the Mo 626 Digital + app and NBM ATMs without the use of an ATM card.

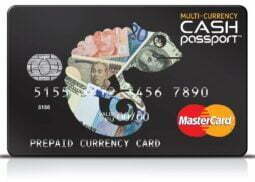

read moreMulti-Currency Cash Passport

The Multi-Currency Cash passport is a preloaded US Dollar and Euro currency card.

A secure way to pay directly for goods and services in restaurants, hotels and shops worldwide.